We have created a simple and easy Employee Attendance Template with predefined formulas and formating. You can maintain the attendance of 50 employees in this template.

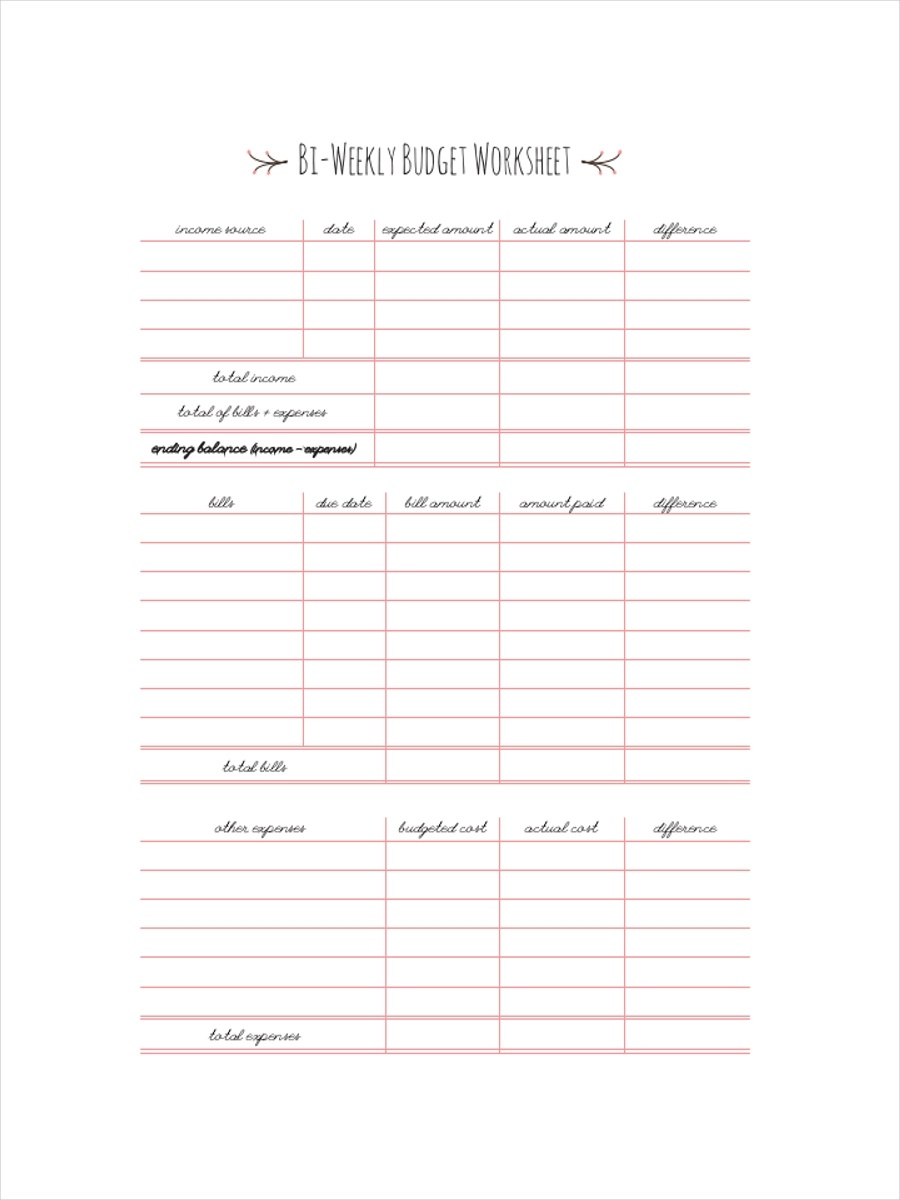

2019 BI WEEKLY BUDGET CALENDAR TEMPLATE EARLY DOWNLOAD

Download Employee Attendance Sheet Template These registers record the number of hours spent by the employee on the job. These payments can be daily, bi-weekly, or weekly. Timesheet Attendance records the man-hours of employees that are paid on an hourly basis. It enables the teachers to maintain the record of students present or absent in their class for a whole academic year. Student Attendance sheets are for seeing the regularity of the student attending the class for educational institutions. Employee Attendance SheetĮmployee Attendance Sheet is a document that records the presence, absence, sick leave, etc of employees for payroll or salary purposes. There are 3 types of attendance Sheets: Employee Attendance, Student Attendance, and Timesheet Attendance. These advanced systems are comparatively expensive and everyone cannot afford it. Slowly and gradually, with the increase in the usage of computers, people started maintaining records on the computer.įurthermore, with the advancement of technology, we can now see the fingerprint machines at many companies. It is used for payroll/salary purposes except for students.Įarlier, people use to maintain attendance manually on paper sheets or rooster books. Contents of Employee Attendance Sheet TemplateĪttendance Sheet is a tool to record the regularity of a student, teacher, employee on a day to day basis.Download Employee Attendance Sheet Template.Step 3: Do you need to spread your monthly bills out? Call them.Įach month has two pay periods (usually), but there are two times a year when you get paid three times a month.Īccording to Grow, “The months in which you take home three checks depends on your pay schedule.

If your first paycheck in 2022 is scheduled for Friday, January 7th, your three-paycheck months will be April and September. If your first paycheck in 2022 is Friday, January 14th, your three-paycheck months are July and December.”īut let’s focus on when you get paid twice a month, as that’s the most common. Take a look at your calendar, are all your bill due dates shoved up in one pay period? Now, it’s not necessarily the number of bills but the total amounts in each pay period. So if in the first two weeks you have $800 in bills due, and in the second half of the month you have $200 due, then that’s bad. That’s making it so that most of your money is spent in the first half of the month, and then you have very little leftover for the rest of the month. You’ll want to call some of your bill companies and see if they can adjust your monthly bill cycle and/or bill due date. Some companies are flexible, and others are more rigid. Some companies let you choose from a few options, while others let you pick any due date. Since we get paid monthly, I have my credit cards close their billing cycle on the 1st of the month. Because you can’t have them close on the 29th, 30th, or 31st as not all months have those dates. Step 5: Write out the first two weeks’ income & bills This ensures that all our spending falls into the month that the money is budgeted.ĭon’t get too obsessed with this just get the closing dates as close as possible to match your planned budget. The key to success with bi-weekly budgeting is knowing exactly how much money you have to spend every two weeks. This is why this budgeting method is easier to stick to. You have less time to spend money without realizing you’ve overspent, which means you’ll spend less overall. I know that sounds a bit confusing, but think about it. If you’re prone to overspending, having a shorter timeline means you’ll be more aware of where you’re at financially because you have to check in with your money twice as often. You’ll need to take your first paycheck income minus your bills in the first two weeks and what’s leftover is for your saving & spending. Yes, you should absolutely be working a savings plan into your biweekly budget. If you haven’t saved much before, start with 5%, and then try and work up to saving 15% – 20%. Ideally, 10% of your savings should go into your emergency fund, with the leftover amount into your sinking funds (use cash envelopes or a savings account). Once you fill up your emergency fund, consider opening an IRA to help your retirement savings. Then after your savings, is the spending categories that you came up with in step 4. Yes, the numbers will look very small, as it’s half of what you normally look at when doing a monthly budget.

In the picture below, this person has gone through and planned most of their month. They’ve done their bills and their sinking funds.

0 kommentar(er)

0 kommentar(er)